The superannuation gender gap – how can we do better?

1 Mar 2018 by Saffron Sweeney

As employees, employers and a society, we need to take immediate action to ensure women across Australia can retire comfortably, with a healthy superannuation balance that reflects the enormous contributions they make to our workplaces and our communities.

It is certainly not news that the gender pay gap remains prevalent within Australia. While several factors contribute to this disparity – including lower numbers of females in higher paying leadership positions, higher representation of women in the part-time and casual workforce and a gender remuneration gap between women and men estimated by KPMG as 16.2% – in Australia, we are falling behind.

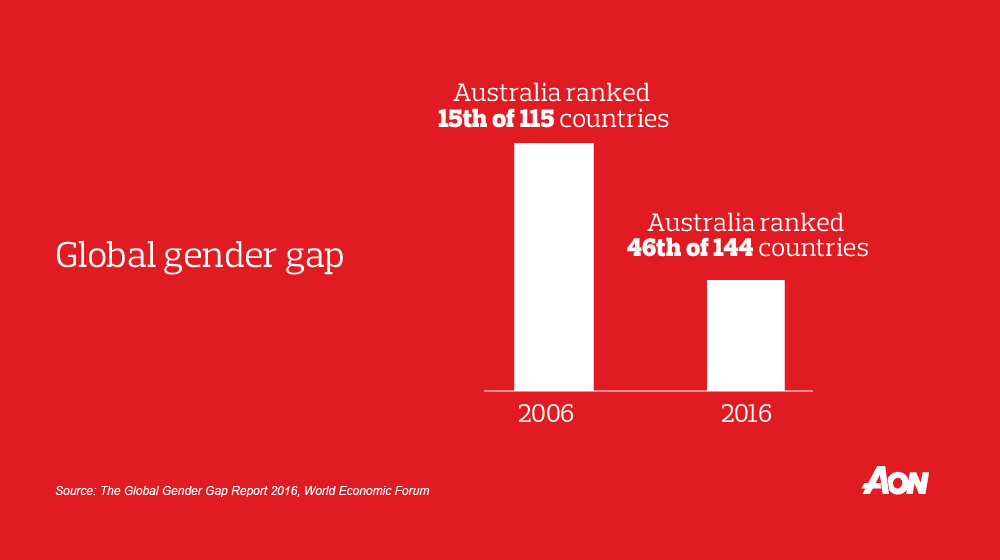

In fact, the 2016 Global Gender Gap Report1 highlighted that Australia’s rank had worsened in the last ten years. Quantifying gender-based disparities and tracking their progress over time across four key areas – health, education, economy and politics – the report highlights that we have a long way to go. Whether we are lagging in policies or simply not progressing at the same pace as other countries, one factor is clear, and that is the corresponding impact this has on the superannuation balances of Australian women – which is so often overlooked. Put simply, we need to act quickly before we fall further behind.

The impact on superannuation

While take-home pay in Australia is currently $260 per week higher (on average) for full-time male workers than for females2, we also know that Australian women do almost double the amount of unpaid work as males1. What’s more, as women are historically much more likely to pause or modify their careers to take on a carer role for children and/or ageing relatives, women’s lifetime earning potential and consequent ability to fund a comfortable quality of life in retirement is clearly compromised.

We know that:

- Australian women retire, on average, with almost 50% of the amount of superannuation as their male counterparts2.

- 90% of women will retire without adequate savings to support a comfortable lifestyle.

- 37% of women report having no personal income at the age of retirement and are therefore fully reliant on the age pension3.

- In retirement, women – particularly single women – are at greatest risk of poverty. Almost 40% of older single females are living in poverty4.

Clearly, this is a widespread societal issue that requires attention. While there is no simple one-size-fits-all approach to address the complex issue of the gender pay gap upon women’s superannuation, we believe that with a multifaceted approach from employers, the government and female super members, women can be empowered to gain greater control and confidence regarding their retirement.

A call to Australia

We have spoken previously about how we can begin to make changes to positively affect retirement for women, for example, in our white papers Women and super: Bridging the superannuation gender gap in Australia and Flexible work and superannuation. There are some solutions that can be employed quickly to see progress, including:

- At the employer-level, companies can review their superannuation policies, like considering paying superannuation during unpaid portions of parental leave. Leading the charge is Viva Energy Australia, who in August 2017 announced they will offer a full-time superannuation payment of 12% pa of their base salary to men and women who take unpaid parental leave, as well as those working part-time, for up to five years.

- At the individual level, women can financially prepare for their retirement by actively managing their superannuation, through voluntary contributions and investment choices. They should also not be afraid to speak up, to raise their concerns with their employers and to be more active in understanding their superannuation and their options.

However, more needs to be done. Several key bodies and individuals have recommended changes to superannuation practices in Australia, which could begin to move the dial on women’s superannuation.

ASFA

- The superannuation rate increase to 12% pa more quickly than legislated.

- Removing the $450/month earnings threshold (as did The Australian Institute of Trustees and Women in Super).

- Allowing higher contribution rates to be paid by employers for women, without breaching anti-discrimination practices5.

Women in Super

- Impacts of budget changes on women be reinstated6.

Fiona Guthrie (CEO of Financial Counselling Australia)

- Maintain contributions while women are on maternity leave7.

Per Capita’s report ‘Not so Super for women’

- Recommended 11 items to the Government, including co-contributions and lower fees for those with lower balances8.

ASFA Superfunds July Magazine (‘Bridging the Gap’), Dr Suzanne Doyle (Head of Advice at StatePlus)

- More women get financial advice and improve their financial literacy.

Start a conversation

Please contact us for help with addressing the superannuation gender gap within your organisation.

1 The Global Gender Gap Report 2016, World Economic Forum http://www3.weforum.org/docs/GGGR16/WEF_Global_Gender_Gap_Report_2016.pdf

2 She’s Price(d) Less: The economics of the gender pay gap, KPMG, 2016 https://home.kpmg.com/content/dam/kpmg/au/pdf/2016/gender-pay-gap-economics-full-report.pdf

3 ANZ Women’s Report: Barriers to achieving financial gender equity, ANZ, 2015 http://www.women.anz.com/content/dam/Women/Documents/pdf/ANZ-Womens-Report-July-2015.pdf

4 A husband is not a retirement plan; Achieving economic security for women in retirement, The Senate Economics Reference Committee, 2016 http://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/Economic_security_for_women_in_retirement/Report

5 ASFA: Superannuation still has a gender issue, 2017 https://www.canstar.com.au/news-articles/asfa-superannuation-still-gender-issue/

6 Barriers preventing women from a dignified retirement outcome must be removed International Women’s Day, 2017 https://clarety-wis.s3.amazonaws.com/userimages/AIST%20WIS%20Remove%20450%20Threshold%20-%207.3.17.pdf

7 Women expect to retire with $200,000 less than men in superannuation, 2017 http://www.smh.com.au/business/consumer-affairs/women-expect-to-retire-with-200000-less-than-men-in-superannuation-20170614-gwqsfk.html

8 The retirement system is failing our mothers, 2017 http://thenewdaily.com.au/money/superannuation/2017/07/20/mothers-superannuation/